Congratulations on the new role. What has been on your to-do list since you joined in September?

Thanks very much – it’s genuinely such an exciting opportunity and I already feel like I’ve learnt so much in a few short weeks. As Marshmallow’s VP of Marketing, I’ll be overseeing the business’s overall brand awareness, reputation and engagement. My core aim is making more people aware of the disruption we’re bringing to a market that has historically had a bad reputation for its outdated and non-inclusive approaches. Marshmallow exists to reduce – and one day eliminate – the distress caused by accidents and disasters. We have an amazing product and have seen how it’s been able to help countless people, so the goal now is to share those brilliant stories.

You previously worked for Dyson in eCommerce marketing and sales – what similarities and differences do you see between your new and old roles?

It’s funny – in some ways the roles couldn’t be more different, but there are some key similarities that are starting to become more apparent. Much like in my time at Dyson, at Marshmallow we’re trying to solve problems that others in the sector haven’t had the appetite – or indeed willingness – to address. In both roles we’re experiencing rapid growth and are creating genuine change in an industry that is otherwise archaic and stagnant. What excites me most at Marshmallow is the culture of innovation that runs through the entire business. While we might not always get it right the first time round, both Dyson and Marshmallow share a culture in which driving change is actively encouraged from within, and where everyone is asked to challenge and feedback into the process.

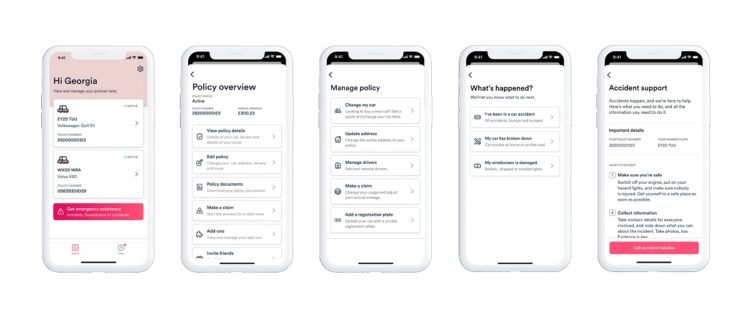

The key difference between the two roles stem from the fact that Marshmallow is a digital-first start up. Whereas my previous role required me to market a physical product, with Marshmallow, our offering exists purely online or via the App. We’re not beholden to supply chains, manufacturers or third party providers. Instead, our in-house engineers and product teams mean decision-making is quicker and we can build in a more agile manner.

Overall, what could the insurance sector learn from the electronics sector?

In the electronics sector, people will return to brands they’ve had good experiences with and they will talk about them with friends and family. The insurance industry can learn from this and the change Marshmallow is bringing to the sector is putting the customer at the very centre to build that trust and credibility.

Insurance is a bit like the doctor, in that the fewer interactions a customer has with us, the better – so making those (hopefully very few) interactions as efficient and enjoyable as possible should be our absolute priority to build positive perceptions.

How would you characterise the Marshmallow brand and what makes it unique?

We are absolutely obsessed with making the customer journey as pleasurable as possible – from enquiring about a quote to the unfortunate instance of a crash or accident on the road.

My view, though, is that the way in which we are viewed externally is an absolute reflection of the culture we foster internally. What we stand for as a brand – supporting people in their hour of need, investing in the technology to make them safer in the first place, and improving accessibility – therefore needs to be clearly articulated amongst our teams as we scale and grow, to ensure we are working to the same common goal.

The company has a strong mission in terms of remaking the insurance sector. Do you think it is essential for financial services companies nowadays to have a clear purpose they can articulate?

It is definitely important, but only if that company has an intrinsic purpose worth articulating.

The importance of purpose is that it sets the culture and tone of how everyone operates underneath it. Purpose is no doubt crucial to the growth of any business, but again, it must be legitimate and credible. There’s no point paying lip service to a purpose that doesn’t really exist – consumers are not stupid and will see straight through it.

Do you view Marshmallow as fitting in more with traditional insurance brands or with fintechs?

Marshmallow is a technology business first and foremost. Being digital-first, tech innovation is at our fundamental core and has been since the business was founded. Our in-house teams are able to quickly flex and adapt to fulfil our customer’s needs and improve our product offering. Because of that digital-first and agile product development, I see we’ve got much more in common with the fintech world.

What is your strategy going into 2022 and what channels do you plan to use to execute on it?

Marshmallow will always be a tech-first business, and so the platforms we use will primarily centre around that. We will work with our engineering and product teams to make sure we continue to create new products and optimise our current offerings. The goal is to build a data-led marketing team, so that we can quickly, test, learn and optimise to find the most effective channels to communicate with existing and new potential customers.