Standard Life is drawing on the example of Chinese financial services giant Ping An as it looks to build a broader financial “ecosystem” for its pension customers, according to Gail Izat, Workplace Managing Director at Standard Life.

The Phoenix Group subsidiary recently launched the Homebuyer Hub, consisting of a range of educational tools that guide customers through the process of obtaining a mortgage and buying a house.

Homebuyer Hub “takes a big financial decision and turns it into easy, understandable steps,” Gail explains. “It helps people feel they can take control.”

The Homebuyer Hub is billed as a “digital coaching solution”, which combines member data with external sources such as surveys to provide personalised guidance alongside behavioural nudges. The company uses a segmentation model, pulling together data about their “age, stage and financial position”.

“You’ll have a specific journey depending on what you want to know,” explains Gail.

This comprises tools, articles and checklists which offer information about stamp duty, how to engage surveyors and guidance on the differences between buying homes in different areas.

“It tries to simplify and cut through the jargon to make topics really accessible and intuitive.”

The strategy is part of a broader effort to engage people about their pensions by offering them advice for their current financial challenges, says Gail.

“What we’ve learned when engaging members in thinking about long-term savings is that it’s got to be relevant,” she says. “If you want to talk [to a customer] about saving long term for a pension, you have to start with what their concerns are in the here and now.

“With younger members who are in the early stages of saving for a pension, there are a number of challenges in engaging them. They are more bothered about getting on the housing ladder.”

These people may be balancing multiple financial goals and might struggle to think about saving for something that is 40 years away, Gail adds.

The concept Standard Life uses to frame this is “financial wellness”, a holistic concept which aims to help these younger savers with their short-term goals and use this as a launchpad to engage them around longer-term goals.

From fear to financial wellness

The Homebuyer Hub sits alongside the Open Finance solution introduced in May, which provides an overview of different financial products to help customers understand their spending and offer helpful nudges.

Gail sees the focus on financial wellness, defined as feeling confident, secure and empowered, as a positive change for the industry. She cites her experience working in other industries such as telecoms, where she highlights how passionate people can be about their choice of phone brands.

“Why are pensions different? I think fear is a big part of it. Fear is not a good motivator; when things feel overwhelming the natural tendency is to not engage.”

Homebuyer Hub has now launched with about six pension schemes, with the goal to roll it out to several thousand.

While the tool serves as a benefit for employers to offer their staff, in the longer term the goal is for those staff to remain customers of Standard Life even after leaving the workplace.

The workplace serves as “an entry point for the relationship with the customer.

“We spend our lives obsessing about how to get people to engage. It’s often people giving up free money, if their employer is matching their contributions.”

“Employers want us to offer wider financial wellness; we want to create valued relationships with members to stay with us in the long term.”

The ecosystem model

The tool fits into the idea of a broader ecosystem of financial products, an idea championed by the Chinese financial services giant Ping An, which uses a broader suite of auxiliary apps to attract customers for its core financial products.

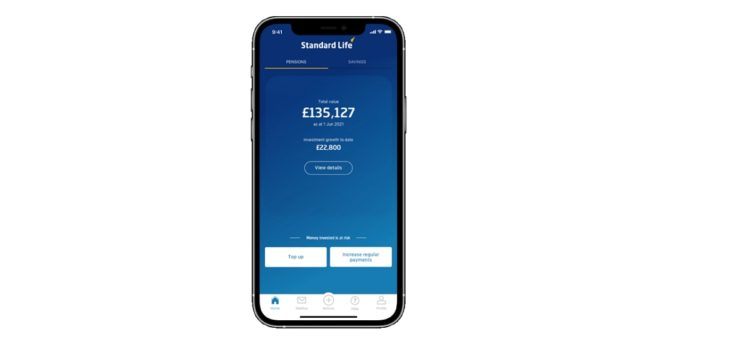

At the centre of all of this is the app, which is moving towards being a one-stop shop that people can use to build their financial confidence. As well as Homebuyer Hub and Open Finance, the app offers a pension finder tool where people can find their lost pots, as well as a retirement planning tool.

“The idea of an ecosystem is exactly how we approach it,” says Gail. “You can access the Homebuyer Hub through the mobile app you get with your pension.”

Gail says that the mobile app has become an increasingly popular engagement model during the pandemic. The plan is to continue to add solutions to the ecosystem by working with best-in-class partners, just as the Homebuyer Hub was delivered through partnership with Life Moments.

“We’ll be relentlessly driven by member and customer needs to provide whatever they need to help them engage.

“We see a need, create a pilot to see if it makes a difference, then launch.”