Standard Life is working with open banking software company Moneyhub to offer a commercial pensions dashboard.

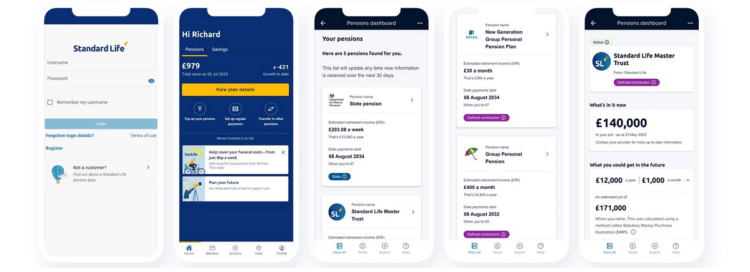

Built on Moneyhub’s white-label software, the dashboard will initially allow Standard Life’s 4 million customers to find and view lost state, workplace and personal pensions.

The new tool is designed to be embedded in Standard Life’s existing customer app, which provides pension management as well as offering the financial wellness tool Money Mindset. This uses open banking to connect pension data with other services such as bankings, credit cards, savings, property values and mortgages.

Standard Life aims to launch the dashboard when the FCA’s regulatory approval process is in place.

Ultimately, the plan is to extend access to all 12 million UK customers of Standard Life’s parent group Phoenix.

While the UK government is working towards offering a pensions dashboard providing visibility of people’s pensions, this service aims to go beyond this and provide onward journeys such as lifetime modelling and consolidation.

Gail Izat, Managing Director of Workplace at Standard Life said the company was “leading the way in shaping the future of retirement saving by giving customers greater certainty and a truly holistic view of their finances.”

“With nearly £27bn in lost pensions in the UK, the Pensions Dashboards Programme has the potential to radically change people’s ability to understand and manage their pension savings.

“But saving is only one part of the retirement journey. Accessing this money at different times through different products and in different forms brings additional challenges for retirees. It may seem obvious but simply knowing how much all your pensions are worth will allow you to plan for the future and understand what you can do today to have enough money to allow you to live your desired lifestyle later in life.”

Samantha Seaton, CEO of Moneyhub, said: “The government’s Pensions Dashboards Programme has been urging providers to continue with their plans and Standard Life has seized the initiative.

“Standard Life has the foresight to understand that pensions can’t be looked at in isolation and must be considered in the round, with a full holistic view of an individual’s finances. To encourage more to save into their pension for retirement, more engagement is needed to inspire better savings habits from day one.

“At a time when finances are increasingly squeezed, Standard Life’s pensions dashboard will seamlessly integrate with its Money Mindset app to enable customers to have a better understanding of their money and wider finances.

“It will help savers build their emergency pot, spot saving opportunities, and develop habits to improve their overall financial wellbeing, and subsequently their later life finances. Through AI-driven smart nudges and personalised seeded content the Money Mindset app both supports and educates the user throughout their financial journey.”