Alice Pukhova, Creative Researcher at WMH&I, explores how new apps are building trust amongst Gen Z.

Younger generations have little trust in traditional banks and financial services. They are being ghosted by Gen Z. The big four UK banks lost nearly 25% market share over the last decade as younger generations have opted for the new breed of fun, easy-to-understand digital fintech brands.

Today’s Millennials and Gen-Zers saw what happened to their parents during the 2008 financial crash and quickly grasped that “too large to fail” was a scam. When today’s youth venture into the scary world of finance, the prospect of signing up with their parents’ banks cuts little ice. This has opened the way for new digital services to snatch this constantly growing group in desperate need of guidance. After all, almost 2 in 5 young people don’t understand how a mortgage works.

So, what does Gen Z want from financial services? For a start, simplicity – financial services education at school was close to non-existent so the service needs to be easy to use and described in the simplest terms. Some 55 per cent of 18-24 year olds do not feel confident about managing their money, while Savanta found just 20 per cent of gen z would use a financial adviser – 47 per cent would first go to a family and 41 per cent said social media was their first choice.

Transparency is vital – they need to know where their money is going. Meanwhile, Gen Z crave understanding. Youth want evidence that a finance brand understands these challenges. And they do love a gimmick – not too much, but having an angle helps grab our attention and appear innovative.

- Simplicity: the convenience of Revolut

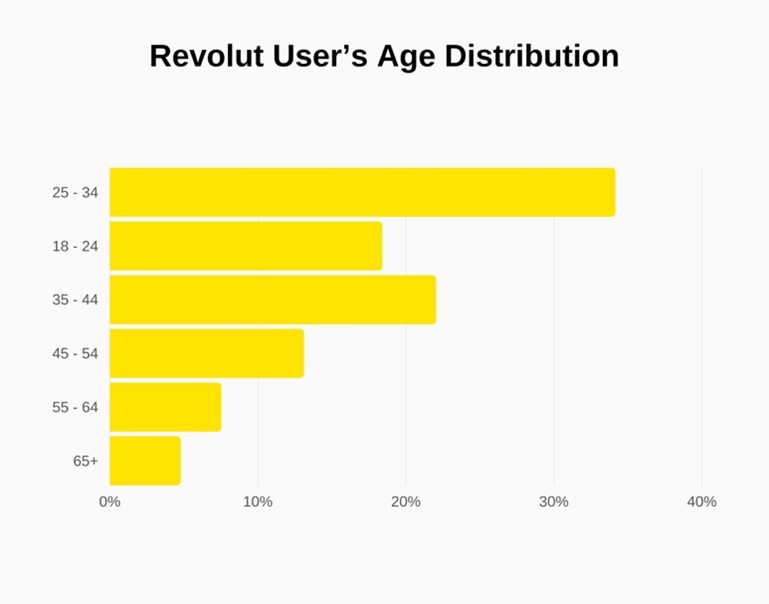

The majority of Revolut’s users are under 34. How did they achieve this?

Simplicity and convenience. While some may still struggle with Revolut’s technology, many users would agree with their claim that they “make day-to-day spending a breeze with all things money in one place”.

Opening an account takes minutes and can be done on the phone. Features such as subscription management, bill splitting, rewards, and automatic savings target and alleviate common money-management issues younger people face.

Revolut’s accessible approach to budgeting resonates with younger generations, demystifying the complex process and aligning with their tech-savvy mindset. In their 2022 campaign “Your Way In” Revolut aims to “crash through [financial] traditions to unlock a world of money that most people never thought they could be part of,” showing how easy Revolut makes intricate processes, like stock trading and investing, cryptocurrencies, or currency exchanges.

This commitment to demystifying finance continues to grow Revolut’s youthful customers.

- Transparency: DeadHappy speaks up about death

Most life insurance companies discuss the matter in a very careful way. Talking about death is uncomfortable, even more so if money is involved. But wouldn’t it be more honest and productive to just say it as it is, avoiding all the vague innuendos?

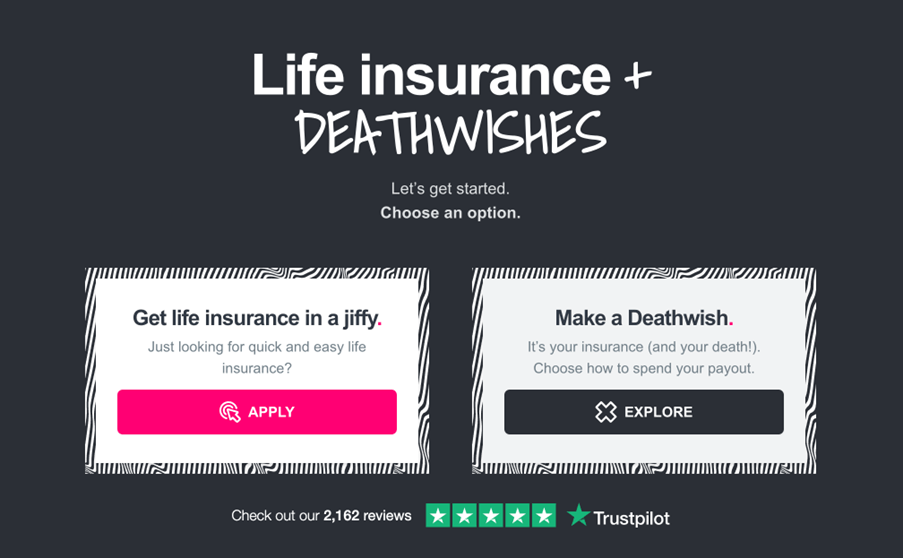

DeadHappy takes this approach and faces death head-on, making light of the absurd subject. The first question they ask you is simple and transparent – “What do you want to happen when you die?”. This is then lightened with death-related puns such as “Life insurance to die for”, “RIP long boring forms” and “Make a Deathwish”. Us young’uns are more than familiar with dark humour, making fun of the inevitability of death or the desire to quicken the process, so it’s about time the death industry uses this.

DeadHappy takes this approach and faces death head-on, making light of the absurd subject. The first question they ask you is simple and transparent – “What do you want to happen when you die?”. This is then lightened with death-related puns such as “Life insurance to die for”, “RIP long boring forms” and “Make a Deathwish”. Us young’uns are more than familiar with dark humour, making fun of the inevitability of death or the desire to quicken the process, so it’s about time the death industry uses this.

The transparency isn’t only in their language but also in their practices. The application process is clearly outlined on the website, and they utilise a transparent pay-as-you-go pricing system. They also promise to use clear and plain language to ensure complete understanding.

DeadHappy’s transparency surrounding death is what makes the brand refreshing, captivating, and trustworthy.

- Understanding: Habito relates to the struggle

Mortgages are confusing, intimidating, and most of us don’t like thinking about them. We are told how buying a house within our lifetime is a pipedream.

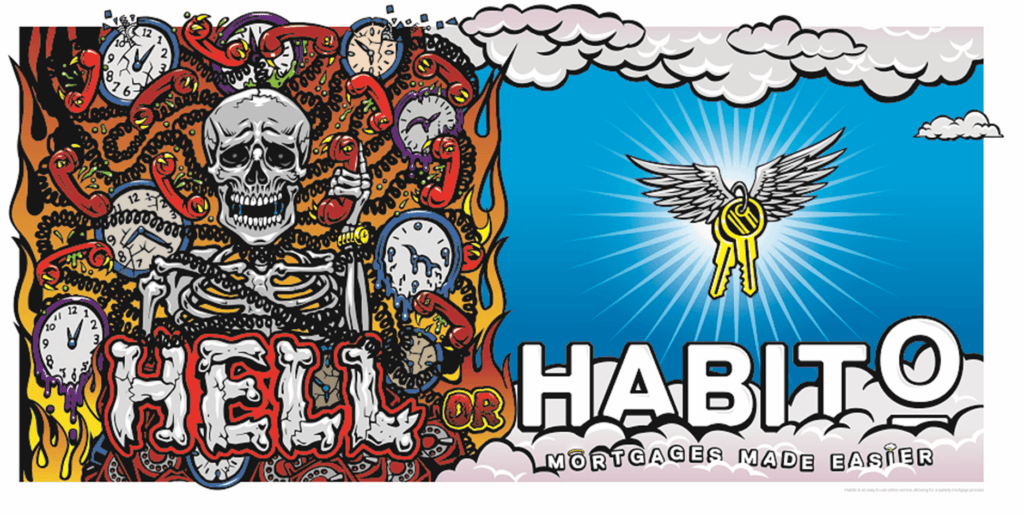

Habito acknowledges this, as they state: “For far too many people, buying a home and sorting a mortgage is disempowering and confusing.” This belief is also the foundation of their 2018 campaign “Hell or Habito”, which is a series of gory animations contrasting the nightmarish process of traditional mortgage applications with the streamlined experience offered by Habito.

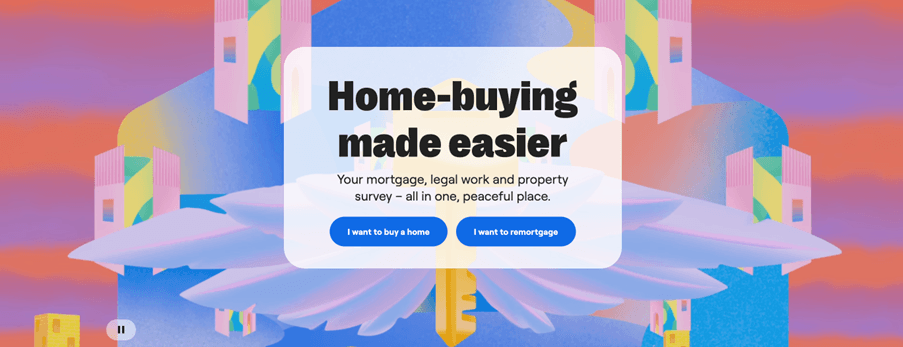

To make the experience more peaceful their website is coloured in soft pastels with pleasant animations. They provide free advice and do the stressful part of legal work and survey.

These relatable sentiments confirm that the problem isn’t personal but systemic. We can trust Habito, as they say: “We know this is difficult, but don’t worry! We’re here to help.”

- Gimmicky: Ellevest wants women to invest more

Having apps or services dedicated to a specific group of people, often minorities, is rather novel. Especially in a traditional field like finance, where people may be afraid to admit how systemic oppression and biases can give some people the upper hand. In the UK, women grapple with financial abuse, unequal contracts, and exorbitant credit rates, exacerbated by male-centric financial campaigns. This results in 41% of women lacking investment confidence.

Having apps or services dedicated to a specific group of people, often minorities, is rather novel. Especially in a traditional field like finance, where people may be afraid to admit how systemic oppression and biases can give some people the upper hand. In the UK, women grapple with financial abuse, unequal contracts, and exorbitant credit rates, exacerbated by male-centric financial campaigns. This results in 41% of women lacking investment confidence.

Ellevest is a finance app designed for women, founded to bridge this gap. Acknowledging women’s unique financial needs arising from longer life spans, career gaps, and pay disparities, Ellevest tailors its investment approach accordingly. By addressing an underrepresented demographic, Ellevest fosters strong user connections rooted in shared struggles.

Ellevest’s not only empowers women but also resonates strongly with the younger generation’s demand for inclusivity and authenticity.

Declining trust in traditional banks among younger generations and a desire for clear, user-friendly, and relatable services, has set the stage for a new wave of financial options.

The financial services of the future need to embrace these qualities not just to attract this growing crowd, but to establish a genuine connection based on mutual understanding and shared values.