Apart from a royal baby, there’s not much in the way of national celebrations in 2013. The country, however, remains optimistic. JOHN GILBERT looks at individual and household spending for signs of a recovery.

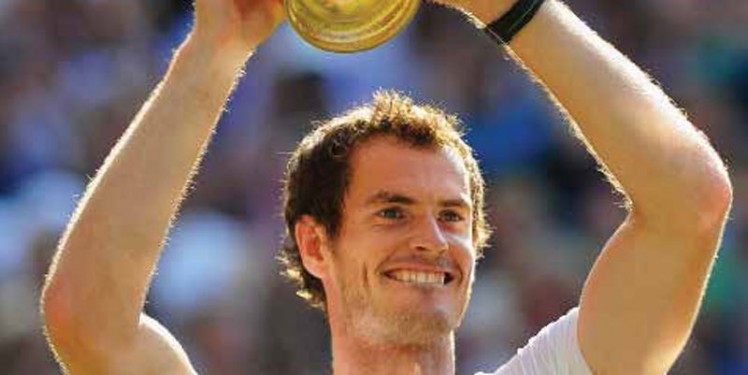

This summer marked the anniversary of London 2012 and memories of last year’s inspirational Olympic and Paralympic Games. Brand Britannia ruled, showcasing Britain at its creative best and enhancing prospects for a lasting Olympic legacy.

In the year since, confidence has slowly improved, despite a painful adjustment process resulting from squeezed household incomes. The impact on the financial services industry has been considerable. Weak product demand has resulted in reduced revenues while increasing regulation and PPI claims have added to costs and dented profits.

The new Governor of the Bank of England Mark Carney takes over an institution with much greater powers of regulation and of big challenges over monetary policy, but needing to work with another Governor who has set out his stall in the June Spending Review – the Chancellor of the Exchequer. This ‘Governor’ has to chart an economic course that gives the best chance of being re-elected in 2015.

A long and winding road to recovery

GfK NOP UK consumer confidence recorded its best 3-monthly measure in June (-23) since January 2011 with the monthly measure up 1 point to -21 following a 5-point jump in May. Compared to a year ago sentiment is 8 points higher, with the 12-month moving average measure up 4 points to -26 and on track to see the best annual measure since 2010.

Increasing economic optimism is behind the jump in consumer confidence with the combined current and future views about the economy at its highest level since August 2010. Despite the pressure on household finances from on-going spending cuts the public appear to be increasingly supportive of government policies.

The JGFR Financial Wellbeing Index (based on personal finances, spending confidence and the net proportion of saving households) gained 5 points to -69 in June, its best level in 2 years while the JGFR Misery Index (based on inflation and unemployment expectations in the next 12 months) jumped 11 points to 91, its best level in 3 years on the back of much-improved unemployment expectations, at their lowest since July 2005.

One group re-connecting with work are the over 65s, now over a million strong workforce. The squeeze on pensions is resulting in more over 65s returning to work. Pensioners are more confident (-23) than younger baby boomers (-26) with some notable role models including the still-working Rolling Stones.

Weak demand for big-ticket spending

Despite the headline gain in confidence and government-induced measures to stimulate lending, the public are in cautious mood.

In the Q3 JGFR/GfK UK Financial Activity Barometer mortgage intentions and property purchase intentions remain well below long term averages. The JGFR Housing Market Index combining both measures is 1 point higher on the quarter at 54.5 (10 points up on June 2012) but well below its long run average of 80.8. Prospects for a summer housing market bounce outside London and the South East look unlikely, especially if mortgage rates edge higher.

One puzzle in recent quarters is the very strong car sales but weak demand for car financing plans. The latest CFP intentions are close to recent survey lows pointing to a sharp decline in car sales, in contrast to industry expectations of strong H2 sales.

Financial services business volumes outlook is flat

For financial services providers the outlook in for the next two quarters is of little improvement in business volumes. Sixty nine per cent of adults intend to save, invest, borrow or repay debt, unchanged on March and a year ago. Fewer people intend to borrow (11%) than last quarter (14%) or a year ago (12%), with slightly more people intending to repay/pay down debt (25%), far more than a year ago (18%).

The Q3 JGFR Financial Activity Barometer* (see Figure 2) shed 3 points to 87.8, little changed on a year ago. Of the underlying indices the most striking note is the jump in the Debt Repayment Index and weakness of Borrowing Index as consumers continue to prioritise debt reduction.

The JGFR Savings & Investment Index has weakened over the past year on the back of low deposit rates. Fewer people intend to place a cash deposit or put money into an ISA in the next 6 months than a year ago. The proportion of people intending to put money into an ISA also dropped, down 2 points from 31% in March and down from 35% two years ago.

Investor sentiment is slightly higher. Fourteen per cent of adults intend to invest in equities or bonds, up from 12% in March and a year ago. More adults are turning to bonds rather than equities.

Despite the introduction of auto-enrolment and the need for long-term pension savings, regular pension contributions in prospect slumped. One-in-five adults intend to make regular pension contributions, down from one-in-four in March and well below the long-term average of 29%.

Fewer people intend making a life/pension scheme contribution in the coming months, down to 32% from 36% in March and well below the average of 39%.

With the UK banking market in the throes of legislative upheaval and a great desire to see new competitors, the latest UK Banking Barometer shows the continued dominance of the established branch banking brands.

Among the public, 90% have a designated main financial services provider, of which 85% (84%, June 2012) cite one of the ten leading bank brands (including Nationwide). Lloyds TSB and Barclays brands continue their decade-long stranglehold as the leading MFSPs.

Barclays, HSBC, Royal Bank of Scotland and First Direct are the main brand winners this quarter. Both challenger brands Santander and Nationwide have failed to consolidate success last autumn.

To date high profile brands such as Tesco Bank, Virgin Money and M& S Bank have made little impact as MFSPs. The launch of the Post Office current account should enhance competition next year.

The key to success in the current account market is to have an active customer base that provides opportunities for cross-selling but also to understand what the customer wants from the relationship.

Beyond London 2012

As financial brands review their sponsorship and corporate social responsibility involvement the JGFR/GfK London 2012 Legacy Report gives pointers to the mood of the consumer towards legacy as a result of the Games:

• 47% believe major economic benefits will flow to the UK

• 57% believe a sporting legacy is left

• 24% of people are more active

• 45% would support a charity that made a difference to young peoples’ lives through sport

• 18% will follow/watch sport more

• 8% have become a volunteer in sporting and community activities

• 57% believe that corporate sponsors need to understand more the role that sport plays in the lives of their customers, employees and communities.

In an age of ‘big data’ the need among financial services businesses is to show customers a human side. The ‘Team GB effect’ and this summer’s sporting and musical festivals highlight this mood of togetherness.