Or structured products. Or with-profits. Or anything else that features any kind of mechanism intended to offer downside protection. For racing drivers, they’re all non-starters.

Does your car have ABS brakes? These days most do. ABS is the system that prevents your wheels from locking up and skidding when you brake too hard, usually on a road that’s wet or icy. The instant the system detects that your wheels have locked, it releases the brakes so the wheels unlock: then it activates and de-activates, ten times a second or more, so that the brakes are applied as much as they can be without locking the wheels. Meanwhile, you just keep your foot on the brake pedal, aware only that the car is stopping and there’s a slightly odd juddering feeling. In this way, ABS prevents thousands of accidents every day.

Racing drivers often need to slam on the anchors, so why don’t any of them want ABS brakes? Partly, it’s because the system adds three things that racing cars really don’t need: cost, complexity and weight. But there’s a more important reason: racing drivers have the skill to manage without it. They can feel the wheels starting to lock when they brake on a wet road, and they can get that on-off-on-off slight juddering effect with their right foot on the pedal. In fact, they can usually stop more quickly with their right foot than you and I can with our fancy ABS.

As a result, not only do racing drivers dislike ABS. They look down their noses at those of us who do like it.

Who’s right? Actually, we all are. Mixing sporting metaphors, it’s horses for courses. We amateurs are right to want ABS. And the professionals are right not to want it.

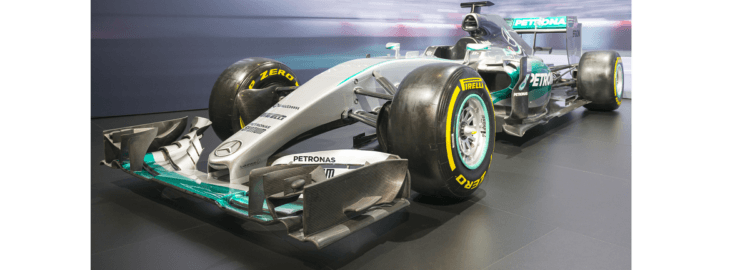

ABS is just one of a hundred, or maybe a thousand, ways that a Formula 1 racing car is different from a VW Golf. The racing car caters, in every way, to the needs of a professional driver who wants to win races. It doesn’t have a glovebox, or a stereo, or central locking. The Golf caters to a completely different driver who wants to take children to school and go to shops. It doesn’t have digital telemetry, or super-soft tyres that are worn out in 20 minutes, or a cockpit so tight that you have to remove the steering wheel to get in or out.

In this analogy, you’ll have spotted that the racing drivers are behaving like investment advisers. They want funds, and fund platforms, and fund tools and information, that fit with their professional approach and let them do their professional thing. This does not include mechanisms that offer downside protection. To the professional, these add cost and complexity, and don’t do anything useful: in long-term investment, you just wait for the markets to come back.

Amateurs have very different requirements. Most don’t want or indeed understand all that telemetry, with those graphs about Efficient Frontiers and inverse yield curves. But when it says on the news that £20 billion has been wiped off the value of stocks today, they like the idea that their gains are locked in and they haven’t lost a penny – even if, in reality, they have, because they paid quite a few pennies for the protection.

Who’s right? Same as with the cars, we all are. We and the professionals are right to want different things.

But here’s the difference. We’ve already said that a racing car is a completely, totally different kind of thing from a hatchback. They’re 100% not interchangeable. You couldn’t possibly take the kids to school in this year’s Red Bull Racing RB19 Formula One car. And Max Verstappen wouldn’t get far at Monaco or Monza in your Golf. But when it comes to investment funds, what the amateurs and the professionals get is very largely the same.

On the whole, they’re the same funds, managed by the same managers, pursuing the same objectives, providing the same information, issuing the same factsheets, traded on the same or very similar platforms, levying the same charges and performing in the same way. The professionals look down their noses at any funds, or categories of funds, that are specifically designed to meet the needs of the amateurs, and their influence on the industry is usually strong enough to ensure they have little presence in the market.

If you’ll forgive one last change of angle in a somewhat overcrowded article, what interests me about all this is how it intersects with the Consumer Duty. The regulator talks a good game about tailoring propositions, and communications, to meet the needs of different kinds of people in the market, to make sure they get the outcomes that are appropriate to them.

But do they understand that this means serving one market sector with Red Bull RB19s, and another with VW Golfs? Or do they think it means basically delivering the same proposition but dumbing down the comms a bit for the amateurs?

I don’t know, and I don’t think anyone much does. But until we all do, I don’t think we can really say we’ve thought this one through yet.

Lucian Camp is a financial services brand consultant, copywriter, author and blogger. He co-presents the On The Other Hand podcast.