The CEOs of Blackrock and State Street have both decried the growing backlash against ESG investing at the World Economic Forum in Davos, as the strategy comes under greater scrutiny.

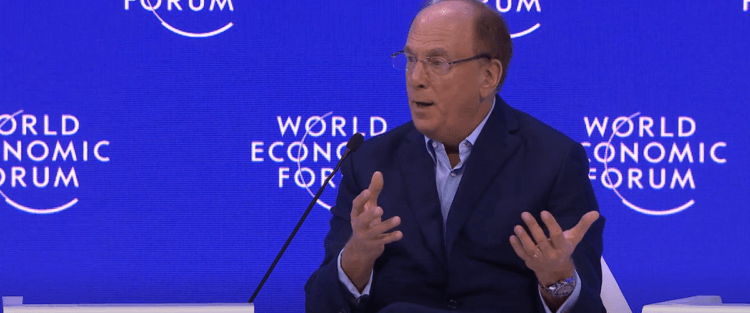

At a Bloomberg News event in Davos, Blackrock CEO Larry Fink said that the ESG debate had become “ugly” and “personal”.

BlackRock, the world’s largest asset manager, has attracted the ire of Republican state administrations in Texas and Florida for pursuing green objectives. The second largest asset manager, Vanguard, withdrew from the Net Zero Asset Managers (NZAM) initiative in December.

Fink spoke about the contradictions inherent in the industry, saying that Blackrock is “one of the largest hydrocarbon, if not the largest hydrocarbon investor (sic) in the world” due to being an indexer while also “one of the fastest-growing companies related to decarbonisation”.

He highlighted Blackrock winning the pension plan of a major hydrocarbon company and its work with major energy companies on their pathway to decarbonisation.

“If we were that enemy that we’re being accused of being, I don’t think we would have those types of relationships.

“As my letters wrote, we have to be working with energy companies not against.

“I’ve always said: we are hostile against divestiture. Divestiture, it just moves from public hands to private hands.”

The issue was echoed by State Street CEO Yie-Hsin Hung, who said asset managers were in a “challenging position”, in an interview with Financial News.

This is not the only challenge the ESG investment world is facing. A group of NGOs released research earlier this week which found that the financial institutions that are signatories to net zero alliances continue to invest large amounts of money into fossil fuels. The research looked at the Glasgow Financial Alliance for Net Zero (GFANZ) and the sector-specific alliances within it such as NZAM.

Paddy McCully, Senior Analyst at Reclaim Finance, one of the NGOS behind the research, said: “GFANZ members are acting as climate arsonists. They’ve pledged to achieve net zero but are continuing to pour hundreds of billions of dollars into fossil fuel developers.”

Signatories to NZAM pledge to support investing aligned with net zero by 2050 at the latest. The report found that 58 of the largest members held at least $847 billion of stocks and bonds in 201 major fossil fuel developers as of September 2022.

Of course, as Blackrock’s Fink does, many of these asset managers may have good explanations for why this is the case and why these investments don’t detract from their net zero mission.

The challenge is that these nuanced explanations are unlikely to achieve as much cut-through as a description such as “climate arsonists”.

There is a danger that the asset management sector ends up in the worst of both worlds from a communications perspective: being attacked from the right for prioritising ESG goals over returns and from the left for prioritising returns over ESG goals.