After the success of the Olympic Games, there is a buoyant mood among consumers. And as John Gilbert reports, financial services’ providers wishing to harness the positive effect this has had on behaviours should work to understand their customers better.

It is no surprise that the nation’s feeling of togetherness and happiness soared after this summer’s Olympics and Paralympics. The ‘Team GB effect’ has been enormous – creating a very strong socially cohesive national brand.

The JGFR/GfK Olympics Barometer of post-London 2012 attitudes found seven out of 10 believe the Games brought the country together and made us feel happier. The Games fostered a sense of social cohesion, with support from all socio-demographic groups.

Funding the Olympics required considerable support from corporate sponsors, with the majority of consumers (54%) believing they played a major role in the success of the Games. For the legacy to succeed, however, there is a belief among 61% that corporate sponsors need to better understand the role sport plays in the lives of their customers, employees and communities.

On the road to recovery?

In the first estimate of UK Q3 GDP, the Olympics effect was a notable contributor, helping the economy grow by a bigger-than-expected 1% and out of the double-dip recession. Prospects for the remainder of the year remain uncertain but are showing signs of recovery.

October’s economic sentiment indicator (ESI), produced by the European Commission for the UK, is at 97.1 the best since July 2011, showing strong growth in industry, services and retail trade measures. Only in construction and consumer confidence are measures down on the month.

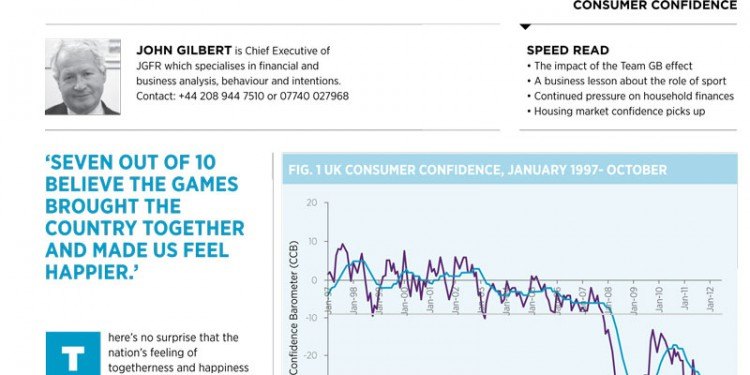

Neither the Diamond Jubilee or the Olympics boosted headline consumer confidence. Between April and September confidence edged three points higher to -28. Any figure below -20 points to the economy being in low growth/recession mode.

In October, headline GfK confidence slipped back two points to -30, the lowest measure since last April, but two points higher than a year ago. The regional jump in confidence between July and September seen in Wales, Scotland and Northern Ireland during the summer fell away this month.

While there is a notable improvement in sentiment towards jobs compared with a year ago, household finances remain under great pressure. Far fewer households (35%) are saving compared to a year ago (45%), with more making ends meet (48% v 40%), drawing on savings (11% v 10%) and running into debt (5% v 4%). The JGFR/GfK Financial Wellbeing Index fell to its October 2008 record low (-103 v 11-year average of +14) reflecting the weak state of personal finances and of spending confidence.

Consumer spending is likely to be restrained in Q4, with measures of both household goods and major purchases continuing at weak levels. This indicates Christmas trading could be tough.

Housing market outlook best in two years

Boosting demand to generate growth is at the heart of current efforts by policymakers, with this summer’s Funding for Lending scheme designed to stimulate mortgage and small business lending.

Good news is that housing market confidence has picked up strongly. In the Q4 UK Financial Activity Barometer both mortgage intentions and property purchase intentions (the latter boosted by cash buyers) show their highest levels in two years.

For financial services providers, the outlook in Q4 and Q1 2013 for business volumes is much improved, particularly for credit products. 73% of adults intend to save, invest, borrow or repay debt, up from 68% in June and 69% in September 2011, and the highest proportion since June 2010.

The Q4 JGFR Financial Activity Barometer (see Chart 2) gained three points to 90, its highest since March 2011. The JGFR Borrowing Activity Index surged 12 points to 63.5, its highest level since June 2010. More people expect to need short-term overdraft, credit card and personal loan finance to help them over the next six months.

The JGFR Savings and Investment Index is little changed on a year ago (92.4 v 92.3). 62% of people intend to save or invest, up from 60% in June. 28% of adults expect to place a cash deposit, dropping from 30% in June and well below a 35% long-term average. The proportion of people intending to put money into an ISA also dropped, down from 31% in June to 28% and down from 34% a year ago. Poor returns on cash deposits together with the financial squeeze on households are likely factors in this decline in popularity.

Investor sentiment picked up strongly, with 19% of adults looking to invest in equities or bonds, up from 13% in June. The headline JGFR Equity Buying Intentions Index jumped from 81.7 to 96.9, its best level since December 2010. Such a rise in expected activity may reflect improving investor sentiment, and also shifting asset allocation among investors, with greater numbers of people intending to sell securities.

Despite two major industry changes – auto-enrolment and the Retail Distribution Review (RDR) – taking place this year, designed to improve consumer take-up of financial products, demand for life and pension products is subdued. For much of 2010, life and pension demand remained buoyant but, for the past year, demand has weakened. The JGFR Life and Pensions Intentions Index edged down one point at 83.8. Expected regular pension contributions – the focus of auto-enrolment – dropped to a 10-year low, with just 20% of adults intending to make a contribution, down from 26% in June and a long term average of 29%.

More positively, intended lump sum life and pension product contributions remain well above average, while life insurance contributions in prospect are at their highest in two years.

The rise of challenger brands

With the UK banking market in the throes of legislative upheaval and structural change as new entrants emerge in the market, the latest UK Banking Barometer shows Santander and Nationwide have entered the top five main financial services providers (MFSPs) for the first time. Extensive current account advertising during the summer may have helped boost market share.

Among the public, 91% have a designated main financial services provider, of which 86% cite one of the ten leading bank brands. There is a bigger reduction in the share of the top five brands, down from 66% to 58% over the past 12 months.

Lloyds TSB and Barclays continue their decade-long stranglehold as the leading MFSPs. Lloyds TSB retained leadership on the quarterly measure; Barclays regained 4-quarter moving average leadership.

This quarter, more people have been moving to First Direct, which enters the top 10 of MFSP brands for the first time. Co-operative Bank also recorded a healthy gain in MFSP customers and moved into ninth spot.

To date, high-profile brands such as Tesco Bank, Virgin Money and M&S Money have made little impact as MFSPs, although they have established financial services businesses through competitive products. Launching a current account to become an MFSP requires a big commitment in investment with less certainty in revenues in a tough economic climate. Having an active customer base provides greater cross-selling and up-selling opportunities – especially packaged accounts.

Farewell to 2012

How to capture the consumer mood and a 2012 legacy:

• understand the impact the Olympics had on consumers in the summer and use the London 2012 feel-good factor to counter the economic gloom

• have greater focus on the mood and intending activity of consumers within regions

• build loyalty and advocacy through the customer experience and by supporting their interests

• understand the degree to which consumers are prepared to seek financial guidance and advice through different channels, and of the links between confidence and product purchase intentions.