Twitter was subject to a parting shot from outgoing British prime minister Boris Johnson this week in his closing speech to parliament. But while Twitter is usually seen as a peer-to-peer channel and often derided as a political echo chamber, 76% of the UK’s top asset managers by AUM maintain some kind of regular presence on the site.

Twitter was subject to a parting shot from outgoing British prime minister Boris Johnson this week in his closing speech to parliament. But while Twitter is usually seen as a peer-to-peer channel and often derided as a political echo chamber, 76% of the UK’s top asset managers by AUM maintain some kind of regular presence on the site.

There is a vibrant discussion happening on the platform that asset managers can engage in with well-chosen content. For example, Twitter influencer conversations on inflation around travel-related topics showed a 250% quarter-on-quarter rise during Q2 2022, according to GlobalData.

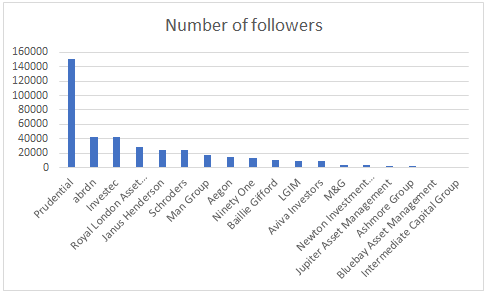

This research delves into how regularly these companies post on the site and how many followers they attract. We looked at the top 25 asset managers in the UK by AUM according to Advratings, 19 of whom maintained a significant Twitter presence. Tweets were analysed for Q2 (beginning of April to end of June) 2022.

Company |

Followers |

Tweets/week |

Percentage of tweets with media |

AUM ($bn) |

| Prudential | 150600 | 2 | 58 | 767.5 |

| Investec | 42800 | 11 | 57 | 80.3 |

| Royal London Asset Management | 29400 | 10 | 86 | 202.1 |

| Janus Henderson | 24700 | 3 | 95 | 404.2 |

| Schroders | 24500 | 4 | 98 | 923.8 |

| Man Group | 17900 | 8 | 30 | 127 |

| Aegon | 14600 | 2 | 35 | 214.5 |

| Ninety One | 13500 | 5 | 23 | 180 |

| abrdn | 43100 | 4 | 48 | 638.8 |

| Baillie Gifford | 10400 | 3 | 43 | 447 |

| LGIM | 9786 | 7 | 84 | 1846 |

| Aviva Investors | 8653 | 11 | 55 | 479.8 |

| Newton Investment Management Group | 3154 | 1 | 0 | 63.7 |

| Jupiter Asset Management | 2412 | 9 | 91 | 80.8 |

| Ashmore Group | 1937 | 7 | 0 | 89.9 |

| Bluebay Asset Management | 1483 | 3 | 57.5 | 75 |

| M&G | 3575 | 1 | 100 | 504.8 |

| Intermediate Capital Group | 469 | 5 | 18 | 59.6 |

It is obviously difficult to compare like-for-like considering the vastly differing sizes and brand presences of the companies on the list. As well as managing different amounts of money, some are large B2C brands while some sell services such as pensions and insurance.

Additionally, there is no way of measuring the results of Twitter activities – for example, how often it translates into a click through to a piece of content and from there to a sale. The six asset managers who maintained no substantial Twitter presence clearly felt it was not worth doing so. Insight Investment, for example, manages nearly a trillion dollars in funds, but didn’t send a single tweet in the period to its 950 followers.

Prudential, Investec and Royal London topped the ranking of follower counts, but it is worth noting that they will have accumulated followers from services outside of asset management or from their operations outside the UK. Some companies will also have follower counts boosted by offering a customer service function. A large number of Investec’s interactions on Twitter relate to its South African offering, for example.

Notably, having a larger AUM did not automatically translate into having more followers, with the largest manager by this measure, LGIM, coming in in the middle of the pack.

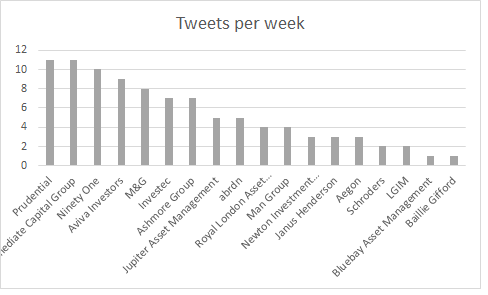

Across the sample, the average company tweeted around 4 times per week, with Aviva Investors, Royal London and Jupiter Asset Management posting the most tweets during the period. This is perhaps a missed opportunity – most estimates suggest brands should post multiple times per day on Twitter – Adobe (at the conservative end) recommends 3 tweets per day, vastly more than even the most prolific tweeters on this list.

On average, 54% of tweets had some sort of embedded media. While posting a link on Twitter automatically populates the post with a featured image, this may be another missed opportunity considering that Twitter’s stats say tweets with video attract 10x more engagements than those without video.

The content generally consisted of a mixture of market analysis and company initiatives.

Company |

Tweets per week |

| Investec | 11 |

| Aviva Investors | 11 |

| Royal London Asset Management | 10 |

| Jupiter Asset Management | 9 |

| Man Group | 8 |

| LGIM | 7 |

| Ashmore Group | 7 |

| Ninety One | 5 |

| Intermediate Capital Group | 5 |

| Schroders | 4 |

| abrdn | 4 |

| Janus Henderson | 3 |

| Baillie Gifford | 3 |

| Bluebay Asset Management | 3 |

| Prudential | 2 |

| Aegon | 2 |

| Newton Investment Management Group | 1 |

| M&G | 1 |

Image: Dkart