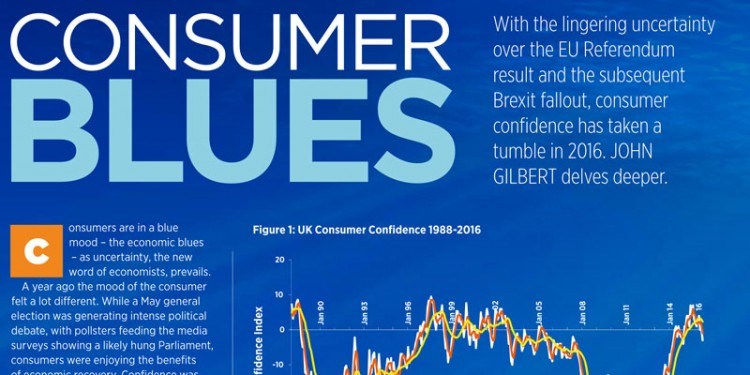

With the lingering uncertainty over the EU Referendum result and the subsequent Brexit fallout, consumer confidence has taken a tumble in 2016. John Gilbert delves deeper.

Consumers are in a blue mood – the economic blues – as uncertainty, the new word of economists, prevails.

A year ago the mood of the consumer felt a lot different. While a May general election was generating intense political debate, with pollsters feeding the media surveys showing a likely hung Parliament, consumers were enjoying the benefits of economic recovery. Confidence was at a 12-year high, household finances were strong and pent-up demand for big-ticket items was unleashed in more relaxed credit conditions.

Not surprisingly in the voting booth, economic optimism won the day and the ‘Year of the Consumer’ was underpinned.

Sentiment was positive in every month during 2015, the first time this has happened since the Consumer Confidence Barometer was introduced in 1974. Most of the key metrics on the consumer dashboard were at, or near, multi-year highs.

In contrast, 2016 looks set to be a down year for sentiment. The GfK Consumer Confidence Barometer in April fell to its lowest score (-3) since December 2014.

A GfK post-Brexit poll taken between 30 June and 5 July shows confidence down eight points to -9, with the economic situation in the next 12 months measure 15 points down on June and 33 points down on July 2015.

UNCERTAINTY RULES

The uncertainty of the EU Referendum outcome certainly stoked consumer fear. Growth has faltered as investment and spending decisions have been deferred.

It’s still early days since the result and the full economic implications of the country’s decision have yet to pan out. Such worries are translating into rising unemployment and inflation expectations which together with forward measures of economic sentiment and personal finances have resulted in the JGFR Feel-Good Index shedding 47 points since its multi-year high of April 2015 to reach its lowest score since December 2013.

Financial wellbeing has not been as affected given the continuing strength of household finances. The combined measure of personal finances used in the headline GfK CCB is five points up in June on 12 months ago; the overall mean measure of household finances is at a 20-year high. Post-Brexit, both measures will fall back.

The dark cloud of indebtedness which threatened the economic climate has lightened in 2016, with the level of households in debt (5%) more around the long-term average, down from around 7% for much of the past six months until March.

As a result both spending and saving confidence remain well above long-run averages boosting the JGFR Financial Wellbeing Index to its highest since January and seven points up on June 2015.

To continue reading the article, please download the PDF version via the Download button above.