Klarna has been one of the most visible of the new wave of buy now, pay later companies. In this exclusive interview, AJ Coyne, Head of Marketing at Klarna UK, talks about the company’s strategy and why working at the UN gave him a fresh perspective on financial services marketing.

- What is your background prior to Klarna and your philosophy on marketing?

Klarna was a really attractive and interesting challenge for me because my background is not specifically in financial services. Before joining Klarna I worked for The Lion’s Share, a United Nations Development Programme that encouraged corporations to make a contribution every time an animal appeared in their marketing or advertising. The ultimate goal was to help raise money for wildlife conservation, habitats and animal welfare.

I helped set the initiative up, and also led from a marketing perspective, signing up brands such as Gucci, Mars Inc, Cartier and others. Before working at The Lion’s Share I was on the agency side, working in various roles across Clemenger BBDO, McCann and Ogilvy.

2. How has this impacted your work at Klarna?

I think in many ways, the fact that I’ve not come from a specific financial services background is beneficial. It means I approach challenges at Klarna from a non-traditional angle.

My marketing philosophy is to be human first always, keep it simple, celebrate your brand’s distinctiveness and to remember creativity is always the answer. Ensure what you do positively benefits your consumer’s lives and contributes to both culture and the market you operate in. Be clear, open and transparent always.

Finally, don’t waste time in years of planning – there will always be a reason to say no. Say yes, move fast, press print if something is 80% there and continually develop ideas with consumer feedback in real time.

3. Klarna is a bank, but it sits outside the traditional players. How has Klarna built a brand that sits outside the traditional financial services space?

This is a question I get asked a lot, and there’s no denying the Klarna team has done an incredible job on the branding and marketing front – not just in the UK, but globally too. Marketing in the financial services space is certainly an interesting challenge.

Amidst the regulations and caveats, it’s easy to go for the bland and tepid option but our view has always been that you can stick to the rules and also inject some personality and fun as well. Those two paths are not mutually exclusive and we’re proud to be different.

If you look around the space you’ll find a sea of blue logos and similar marketing. We’ve made a conscious decision to speak and act differently because we felt the way many brands were communicating in this space was somewhat outdated and simply not resonating with consumers. With that said, we’re a bank ourselves and the way we market ourselves doesn’t mean that we’re less serious about what we do, and what we offer consumers. We’re customer obsessed and have a very strict no-jargon and transparent approach through all of our marketing and communications. Our number one priority has always been, and will always be, making sure our users are safe and protected.

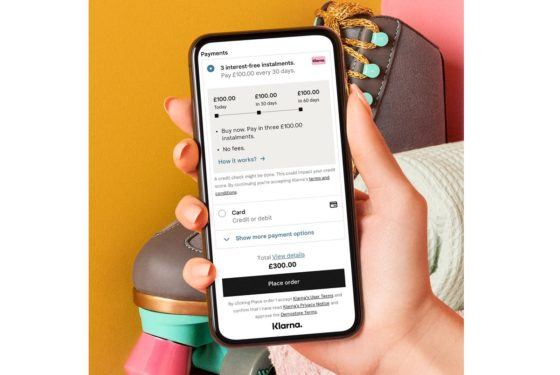

4. Retailers have to embed Klarna in their checkout. How do you market to the dual audience of retailers and customers?

Many marketers in the financial services space will face that challenge at one time or another about how to ensure messaging is joined up when you’re communicating to different audiences, be they B2B or B2C. It sounds obvious, but something that’s always front of mind for me is that business decision makers are people too. There’s a significant overlap between those two worlds and as a brand you’ve got to ensure that your messaging is aligned, no matter the audience you’re talking to.

While we run different marketing campaigns for consumer and merchant audiences, it’s important to us that the Klarna brand voice comes through strongly in everything we do.

My ultimate aim, which I think is starting to happen, is that consumers and merchants can look at one of our campaigns without any logo or mention of Klarna and instantly recognise that it’s something we’d do. Increasingly I feel we’re getting to that point, which is testament to the fantastic team we’ve got.

5. What is the role of above the line advertising in Klarna’s strategy?

In my mind, above the line advertising will always be of paramount importance, and it’s a huge part of our marketing strategy here in the UK. Many people’s first experience with Klarna in the UK was our ‘No drama, just Klarna’ advertising campaign which you might’ve seen on taxis, the bus or on the tube. We’ve since run a number of other ATL advertising campaigns, with our most recent one #WhyPayInterest currently live across multiple UK cities. As part of #WhyPayInterest we broke the UK record for the largest projection advertising campaign ever… there’s plenty more to come on that front too.

6. How does customer feedback shape Klarna’s strategy?

All of our products and marketing are designed to make our consumers’ lives better – as such, customer feedback is central to everything we do as a marketing team. We have regular engagement and conversations with customers where we want to hear the good and the bad, and then act on it to ensure we’re always doing right by our users.

A good example of this in practice is a campaign we ran towards the end of last year called Clothes Love All. Our customers told us that representation in the fashion industry wasn’t what it should be, and many groups were feeling excluded. We took that on board and specifically designed a campaign for everyone, highlighting that fashion isn’t about what you look like, it’s how you feel – everyone should be able to wear the clothes they love, free of judgement. You can watch that here.