Long-term products require a long-term approach to the question of value. Malcolm Oliver explains the principles of customer equity.

The total customer equity of a company is the sum of the lifetime values of each of its customers, discounted to a net present value, after deducting any unallocated costs. It is in effect the total economic value of a company’s customers and potential customers, and is driven essentially by four factors: acquisition costs; retention rates; re-marketing costs; and additional sales. Marketing must focus on these four areas. This emphasizes the point often missed, that specific external marketing activity must be divided between acquisition of new customers, and re-marketing: the nurturing, development and harvesting of retained customers. These activities are separate, if complementary: in some organizations they are best handled by separate teams; in others the benefits of integration will be dominant.

But it is also clear that it is not just a question of acquiring as many customers as possible; or of maximizing the crossselling rates. Each of these activities has a cost as well as a benefit, and striking the right balance is vital.

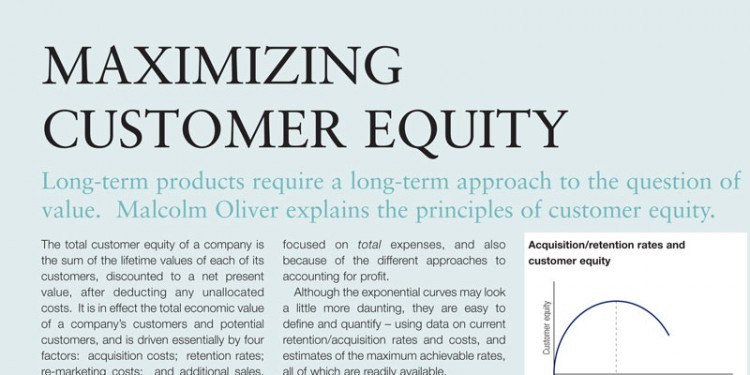

The first year value of an acquired customer is the difference between the margins on the product sold and the acquisition costs. The former increases in proportion to the value of the products sold; the latter follows an exponential curve – small levels of expenditure at first produce significant growth in acquisition rates, but gradually a law of diminishing returns sets in, and eventually a maximum achievable acquisition rate is reached. The optimum level, which maximizes the customer value, is well below this point.

The product margins are clearly defined internally, although sometimes with a degree of difficulty in the case of life insurance products – simply because historically the approach to costing has focused on total expenses, and also because of the different approaches to accounting for profit.

To read the full article, please download the PDF above.